ANNUALPERFORMANCEAND CREDITREVIEW

EXECUTIVE SUMMARY, FISCAL YEAR 2022

WHEN WELOOK ATNUMBERS,WE SEEPEOPLE.

X X X X X

Friends and Colleagues:

At CIC, we focus on numbers, and with good reason. They’re a useful shorthand to describe the work we have to do, and a handy yardstick to measure our success. I’m pleased to present the FY 2022 Performance and Credit Review Report, which has no shortage of performance metrics that help tell our story to our investors and other valuable partners.

But to report on just the numbers—how many affordable rental units we’ve helped preserve, how many loans we’ve made, how well those loans have performed, and all the rest—is to ignore the fundamental driver of our work and our success.

That driver is people.

They are the why, and the how—the foundation of everything we do.

Feel free to review our full annual report, or get a good snapshot from the highlights below. Either way, make sure you hear directly from several of the amazing owner-operators that CIC has worked alongside over the past year; they tell the real story of CIC’s work.

And thanks to our many partners: our Board of Directors, our 44 institutional investors, many government and community partners, and to the small, local developers who provide quality affordable housing to their tenants. Your investment—and trust—fuels our work.

Stacie Young President and CEO, CIC

We See Partners

Lending to improve and preserve naturally occurring affordable rental housing (NOAH) is the core of CIC’s products and services. In FY 2022, CIC continued to help small, local owner-operators and their tenants recover from the pandemic by providing access to flexible capital in Chicagoland neighborhoods that need it most.

Loan volume was strong and steady, with over $63 million in closed loans. Our customers persisted through ongoing economic challenges stemming from COVID, inflation, supply chain issues, and large out-of-town investors who neglect to maintain their buildings. Despite these hurdles, CIC borrowers like LaJune and Jay Yancy made a positive impact on their properties, those blocks and neighborhoods, and the lives of their tenants.

CIC made deals work by offering not only our signature Multifamily rehab loan products, but by layering targeted community development loan and grant sources such as the City of Chicago’s TIF Purchase-Rehab program dollars, energy retrofit financing, and mezzanine debt through the Opportunity Investment Fund. And while we typically lend to small, for-profit private owner-operators, unique CIC deals and collaborations with key community partners like the West Side Health Authority highlight how creatively leveraging new resources is as critical as ever.

Lending By the Numbers

Our lending portfolio remains healthy and balanced and reflects the resiliency of CIC borrowers. As of 9/30/22, delinquencies on Multifamily notes sold to investors stood at 3.5%.

The Yancys

When LaJune Yancy was growing up in South Shore, she swore that when she left, she wouldn’t be back.

Rosie Dawson

Chicago’s community organizations are often a driving force in neighborhood revitalization, and Austin’s Westside Health Authority (WHA) is no exception.

The Yancys

When LaJune Yancy was growing up in South Shore, she swore that when she left, she wouldn’t be back.

“I was discriminated against. I was treated as if I was not human. I hated it,” she says quietly. “But as I got older, it just hit me. I wanted to be able to serve people here the way I had wanted to be served as a youth.”

“Going to CIC for the refi was a no brainer. Just the relationship makes it easy, and I feel like our years of experience mean something.”

LaJune Yancy

Yancy and her husband, Jay, bought their first property in South Shore in 2005. With 28 units, it would have been a lot for anyone, much less new owners with full-time day jobs. They made a go of it, though, and some years later, when both got laid off, they decided the time was right to reinvent themselves.

“We took it as an opportunity to strike out on our own full time in real estate,” says Jay. With savings and some help from CIC, they bought a second building in 2014 and never looked back.

Today, the couple, along with their two adult children, continue to grow their portfolio and give every tenant, whatever their income, a home to be proud of. They also continue to turn challenge into opportunity, and they count on CIC to help them do so.

Their most recent venture, a 20-unit building on South Saginaw, is a fine example. They acquired the property at foreclosure in 2019, put down a nonrefundable $65,000 deposit, then began lining up commitments for the mortgage and construction loans.

“Everything was a go. Then COVID hit, and business ground to a halt,” remembers Jay. “Banks were no longer lending. Even CIC had pulled back.”

Fortunately, Tony Hawthorne, their longtime CIC loan officer, proved as tenacious and creative as the Yancys themselves. Could they do without the construction loan and put 40 percent down for the mortgage?

They could and did.

“CIC came through for us, and we were quite thankful,” says Jay.

After the May 2020 closing, they invested more of their capital in tackling repairs and renovations while working with tenants who could no longer make rent because of pandemic-related income loss.

They weathered the storm, and when money started moving again, they applied to CIC for a first mortgage refinance of the original mortgage, plus a rehab loan. That loan closed in 2022, and with the return of their working capital, the Yancys are considering their next investment.

“Going to CIC for the refi was a no brainer. Just the relationship makes it easy, and I feel like our years of experience mean something.”

LaJune Yancy

Rosie Dawson

Chicago’s community organizations are often a driving force in neighborhood revitalization, and Austin’s Westside Health Authority (WHA) is no exception.

What began as a community-based coalition formed to fight the closure of a neighborhood hospital is today a deeply rooted, well-respected organization working block-by-block to restore health and wellbeing—economic, social, and personal—to those who live on the westside. The tools WHA chooses for this work are community engagement, economic development, job training and employment services, community reentry services, and the development and management of commercial and residential real estate

“To make a project like this work, financially, you need to piece together resources,…and CIC give[s] you everything you need…”

Rosie Dawson

In the latter, WHA and Rosie Dawson, who develops and manages WHA’s portfolio of properties, has found a reliable, like-minded partner in CIC.

“We’ve worked with CIC several times—in fact, it was Laura [Laura Armgardt, then an acquisitions specialist at CII] who told us about 5051–53 West Chicago, which now houses our main office,” says Dawson.

Just down the street from that office is WHA’s biggest mixed-use project to date, 5246–48 West Chicago, featuring four street-level commercial spaces and 20 residential units. The commercial units have already been rented; renovation on the residential portion began mid September 2022, with completion expected late summer 2023.

Dawson’s enthusiasm for the project is palpable.

“For the storefronts, we’re putting the sheriff in the building, so families can feel safe about moving in, and we have Schweet Cheesecake—the owner is a lifelong Austin resident who started her business at home. As far as the residences, we didn’t want just plain apartments here, we wanted luxury apartments. They’re good sized, around 1,000 square feet on average, and 16 of them are two bedrooms.”

The work is being financed with a first mortgage construction loan from CIC, along with grant money from the city, Dawson explains.

“It was CIC who told us about the TIF Purchase Rehab grant funds—capital available to developers who are willing to meet certain affordability requirements. CIC administers that program for the city. To make a project like this work, financially, you need to piece together resources, and one of the great things about working with CIC is that they don’t just leave you in the wind. They give you everything you need to make a proper choice about a troubled building and everything you need to take on the property.”

“To make a project like this work, financially, you need to piece together resources,…and CIC give[s] you everything you need…”

Rosie Dawson

We See

Problem Solvers

CIC is more than Chicago’s multifamily rehab lender.

In FY 2022, CIC offered over 30 trainings facilitated by industry experts on a range of pressing issues affecting local owner-operators, from property management best practices to mixed-use development to landlord safety and crime prevention.

Through its affiliate, Community Initiatives, Inc. (CII), and in partnership with the City of Chicago, CIC made an impact in Chicago neighborhoods by stabilizing over 560 distressed multifamily units through the City of Chicago’s Troubled Buildings Initiative. These distressed buildings present significant hazards for residents, neighborhoods, and first responders. By working quickly and nimbly, CII makes it possible for new owners like Elliot Williams to mitigate risks, rehab the property, provide stable management, and preserve affordable units.

In FY 2022, CIC guided rental preservation policy through the leadership of The Preservation Compact. After years of extensive effort and collaboration led by the Compact, FY 2022 culminated in state legislation and a new Cook County program to provide meaningful tax relief to multifamily properties while also incentivizing rehab and preserving affordability. The Cook County Assessor’s Office launched the new program in early 2022, and CIC borrowers just like Robert Waz and Marcin Kania are already participating to help them expand their efforts to provide quality, naturally affordable housing.

FY 2022 Community Development by the Numbers

Elliott Williams

Anyone considering investing in a building or a neighborhood has to be fairly confident that the opportunity will outweigh the risk.

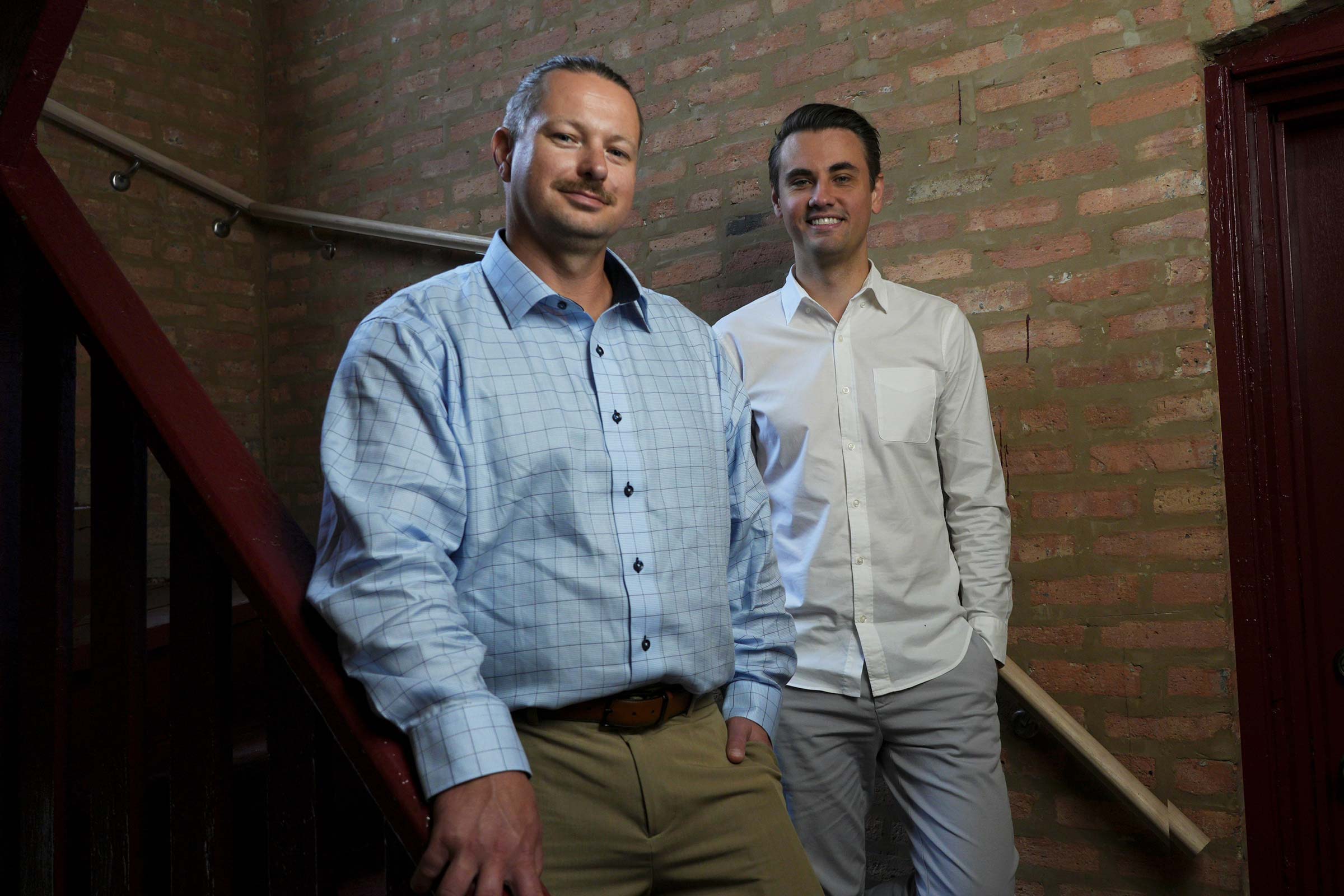

Robert & Marcin

After nearly a decade in the private equity industry, specifically focused on multifamily real estate, Robert Waz understands what makes a successful real estate venture.

Elliott Williams

Anyone considering investing in a building or a neighborhood has to be fairly confident that the opportunity will outweigh the risk.

For Elliott Williams, a part-time developer and full-time IT professional, the confidence to make his latest investments came from a program developed by CIC and the City of Chicago: the Woodlawn Construction Loan Fund.

“The advising from CIC staff along the way is a huge benefit.”

Elliott Williams

For months, Williams had had his eye on two multifamily buildings located just a few blocks south of Washington Park, at 6223 and 6243 South Vernon. He had spotted them on CIC’s website, which features properties acquired by its affiliate, Community Initiatives, Inc. (CII) as part of the Troubled Buildings Initiative. As it does with all its properties, CII had addressed the immediate issues of both buildings. Now, it was looking to identify the right developer to take them on—someone experienced enough to handle a complex project, familiar with the neighborhood, and driven as much by mission as by profit.

“I kept coming back to them,” says Williams, “but we’re not a large company, and at regular market rates, the math just didn’t add up.”

That’s when CIC loan officer Tom Jackson told Williams about the Woodlawn Construction Loan Fund, which offers low-cost, construction phase financing to local owner-developers willing to preserve and develop affordable housing. Williams, who lives with his wife and six children in Englewood, has been doing both for nearly 20 years.

“I guess Tom thought I’d be an ideal candidate, and it was when we heard about the financing that we could finally say, ‘Yep, we can manage this risk,’” says Williams. “He asked me if I was willing to talk to Jonah [director of CII], and the rest was paperwork. I became the first person to get a loan from the fund.”

Today, Williams reports that the nine-unit building is 100 percent renovated and will achieve full occupancy soon. nearly fully occupied. As for the three-unit building, it’s around 90 percent complete, after some of pandemic delays and the challenges of inflation-driven cost overruns. Still, Williams notes, on the 6200 block of Vernon, change is already in the air.

“People are starting to notice that someone actually cares about this, and that energy is contagious.”

“The advising from CIC staff along the way is a huge benefit.”

Elliott Williams

Robert & Marcin

After nearly a decade in the private equity industry, specifically focused on multifamily real estate, Robert Waz understands what makes a successful real estate venture.

When he first sat down with CIC, however, he was a newly minted CPA hoping to launch a successful part-time business with a new partner, Marcin Kania, a broker as well as an experienced developer and general contractor. The two had met through a college friend and had bonded over their interest in real estate and a desire to take on bigger, more challenging projects. In fact, Kania had just bought a vacant six-unit building in North Lawndale. Now, the pair were looking for money to get the project off the ground.

“Anything that can help incentivize investment and really bring these properties back to life is a good thing.”

Robert Waz, Coprincipal, Exterplexy Real Estate & Management

“When we approached CIC, we were just two random guys with a plan, asking for a $350,000 construction loan.”

Waz laughs at the memory. “It took a bit of convincing, but in the end, they gave us a shot, and we delivered. We’ve worked with CIC on many projects since, and it’s been an awesome partnership—they’re just as invested in this as we are.”

Waz and Kania’s focus on developing quality affordable rental housing in North Lawndale makes them a good fit for many of CIC’s lending programs. Typically, 75 to 100 percent of the units in their portfolio—which now totals roughly 200 units—are affordable. Kania oversees property development and management; Waz focuses on the accounting, legal, underwriting, and working with lenders.

With their most recent CIC construction loan, Kania is currently overseeing rehab work on the newest addition to their portfolio, a seven flat on South Christiana. Once it’s complete, the pair may even see tax savings they can use for their next project, thanks to policy changes spearheaded by CIC and its Preservation Compact partners. In August, Waz applied for the newly launched Affordable Housing Special Assessment Program, which provides meaningful property tax relief for multifamily rental properties that include affordable units by reducing a property’s post-construction or rehab value.

“I’m a strong believer that private investment is usually the fastest way to improve a neighborhood, and tax relief is a win-win,” says Waz. “When policymakers incentivize investments in affordability, people like our tenants can afford to stay in their neighborhood and see it get better.”

“Anything that can help incentivize investment and really bring these properties back to life is a good thing.”

Robert Waz, Coprincipal, Exterplexy Real Estate & Management

We See Investors

CIC closed FY 2022 with a financially robust finish. Our solid organizational position means that we have the flexibility to continue to deliver on our longstanding mission, while also responding to evolving neighborhood needs as they arise with new products and programs.

As of 9/30/22, CIC achieved an increase in total consolidated net assets of $1.47 million, resulting in a total of $50 million in net assets. We secured additional sources of new capital, including an expanded program-related investment from the Federal Home Loan Bank of Chicago, a new $30 million Multifamily Note Purchase Agreement commitment from JPMorgan Chase, as well as new commitments from Heartland Bank & Trust and Evergreen Bank.

As always, our FY 2022 results were made possible by the support of long-term institutional investors.

By the Numbers

We See Innovators

As we reflect on our 2022 accomplishments, we know CIC’s work is far from done. 2023 marks the official launch of our new strategic plan, which will guide our work for the next four years. CIC is ready to invest in its next chapter, and remains nimble and responsive to continually evolving market conditions.

Over the coming months and years, we will leverage our transformative lending platform, including financing the first projects under our new Real Estate Equity Pilot Program funded by MacKenzie Scott.

We will prioritize collaboration and engage even more deeply with community partners and local owner-operators, including continuing to support place-based collaborations, as well as connecting the region’s local, diverse developers to expanded capital access and other resources.

And we will undertake all of these efforts through a lens of racial equity and examine our internal and external operations – from staff, board, and policies to our products and services – to ensure that our core values are integrated into all aspects of our organization.

We invite you to stay in touch to join us and learn more about our efforts and partnerships.

newsletter

reach out directly